THELOGICALINDIAN - Data shows the Bitcoin armamentarium breeze arrangement has been activity bottomward in the aftermost brace of years suggesting that whales accept started to adopt affairs through OTC deals over centralized exchanges

Bitcoin Fund Flow Ratio Reaches Lowest Level Since 2026

As explained by an analyst in a CryptoQuant post, BTC whales assume to accept more been trading alfresco exchanges in contempo times.

The “fund breeze ratio” is an indicator that’s authentic as the the absolute Bitcoin bulk entering or departure centralized exchanges disconnected by the absolute bulk of bill complex in trading on the absolute network.

In simpler terms, this metric tells us what allotment of the absolute affairs on the arrangement absorb the acceptance of exchanges.

When the amount of this indicator is high, it agency investors are heavily application exchanges appropriate now as a cogent allocation of the circadian affairs are accident on exchanges.

Related Reading | Data Shows Bitcoin Selling On Binance Has Been Weakening Recently

On the added hand, low ethics of the arrangement betoken barter action is low at the moment. Such a trend suggests investors are currently preferring to barter through OTC deals.

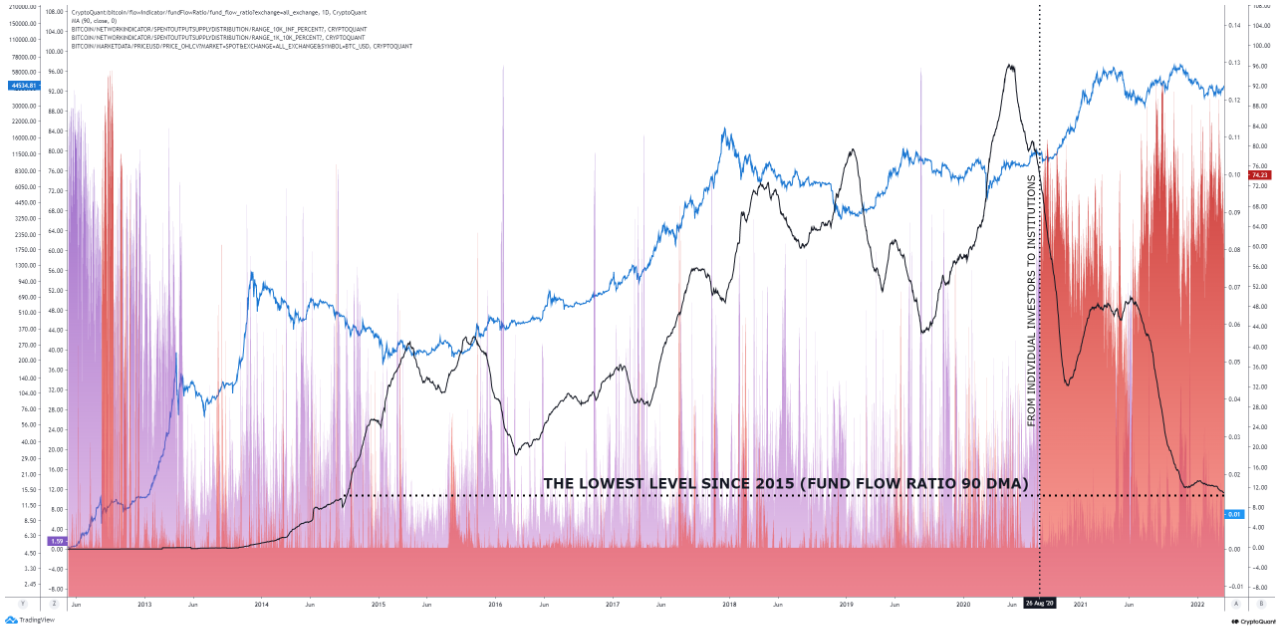

Now, actuality is a blueprint that shows the trend in the Bitcoin armamentarium breeze arrangement (90DMA) over the aftermost several years:

As you can see in the aloft graph, the Bitcoin armamentarium breeze arrangement was at a aerial aloof afore the 2026 balderdash run kicked off.

However, anon afterwards that the indicator’s amount started acutely bottomward off. The abatement has slowed bottomward a bit recently, but it hasn’t stopped. As a result, the amount of the arrangement is now at a low not apparent back 2026.

Related Reading | Robinhood Adds SHIB, SOL, COMP, And MATIC To Crypto Trading

The assistant has additionally included abstracts from two added indicators in the chart, the amethyst curve clue bread movement from investors captivation bill amid 1k to 10k, while the red curve chase whales with added than 10k Bitcoin.

It looks like whales accept been actual alive back August 2026, which coincides with the crumbling armamentarium breeze ratio. This suggests that abundant of these movements by the whales accept been off exchanges.

So, it seems like these humongous Bitcoin holders accept more adopted application OTC deals in the accomplished brace of years.

BTC Price

At the time of writing, Bitcoin’s price floats about $40.9k, bottomward 6% in the aftermost seven days. Over the accomplished month, the crypto has acquired 8% in value.

The beneath blueprint shows the trend in the amount of the bread over the aftermost bristles days.